cost accounting for restaurants

Cost accounting is a crucial aspect of managing finances in the restaurant industry.It involves tracking and analyzing costs associated with various activities, products, or services within a restaurant.

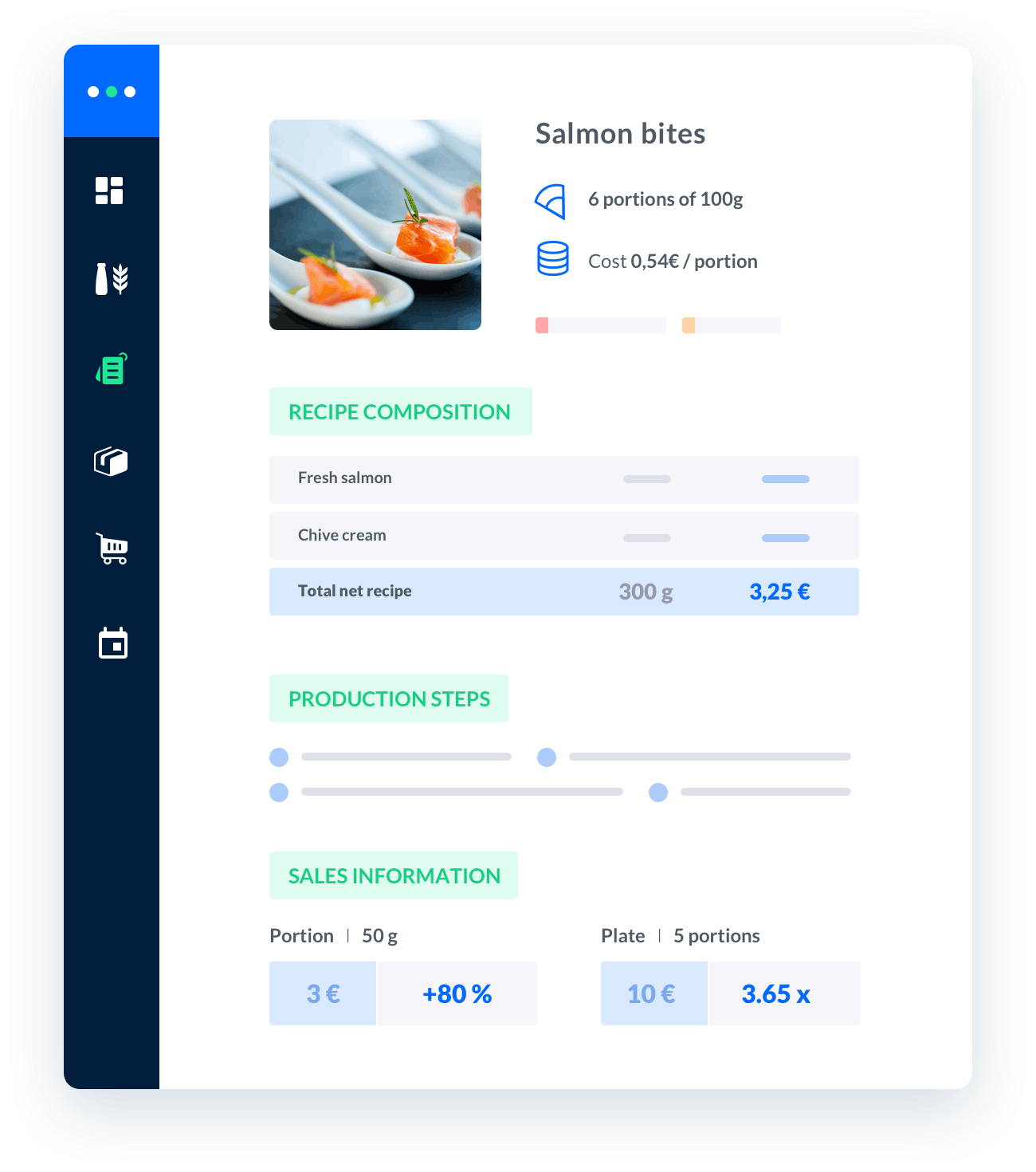

Melba: the food cost app to optimize the profitability of your restaurant

Discover how to optimize the profitability of your restaurant with melba

The ultimate guide to food cost restaurant

Learn more about the food cost basis and how to reduce your food cost percentage

Cost accounting is a crucial aspect of managing finances in the restaurant industry. It involves tracking and analyzing costs associated with various activities, products, or services within a restaurant. By implementing effective cost accounting practices, restaurant owners and managers can make informed decisions to optimize profitability and streamline operations.

The Importance of Cost Accounting for Restaurants

Cost accounting plays a vital role in the success of a restaurant. It helps identify areas where costs can be reduced, wastage can be minimized, and profitability can be maximized. Here are some key reasons why cost accounting is essential for restaurants:

1. Cost Control and Reduction

One of the primary objectives of cost accounting is to control and reduce expenses. By accurately tracking costs, restaurants can identify areas where expenditures are high and take necessary actions to cut down on unnecessary expenses. This can include negotiating better prices with suppliers, optimizing inventory management, and eliminating waste.

2. Menu Pricing and Profitability Analysis

Cost accounting provides valuable insights into the profitability of each dish on a restaurant's menu. By calculating the cost of ingredients, labor, and overheads associated with a particular dish, restaurant owners can determine its profitability. This information helps in setting appropriate menu prices to ensure that each item contributes to overall profitability.

3. Inventory Management

Effective inventory management is crucial in the restaurant industry to avoid overstocking or running out of essential ingredients. Cost accounting helps in tracking inventory levels, monitoring usage patterns, and identifying slow-moving items. By maintaining optimal stock levels and reducing food wastage, restaurants can minimize costs and improve profitability.

Key Components of Cost Accounting for Restaurants

1. Direct Costs

Direct costs are expenses directly associated with producing or serving a specific dish. Examples of direct costs include the cost of ingredients, packaging, and direct labor. By accurately tracking these costs, restaurants can determine the profitability of individual menu items and make informed decisions on pricing and cost reduction.

2. Indirect Costs

Indirect costs, also known as overhead costs, are expenses that cannot be directly attributed to a specific dish but are necessary for the overall functioning of the restaurant. Examples of indirect costs include rent, utilities, insurance, and administrative expenses. Allocating and monitoring these costs accurately is essential for calculating the true cost of running a restaurant.

3. Labor Costs

Labor costs form a significant portion of a restaurant's expenses. Cost accounting helps in tracking labor costs, including wages, benefits, and payroll taxes. By analyzing labor costs, restaurants can identify areas where labor efficiency can be improved, such as optimizing staff schedules and reducing overtime. This can lead to substantial cost savings without compromising service quality.

Implementing Cost Accounting in Restaurants

1. Establishing Standardized Recipes

Standardized recipes play a crucial role in cost accounting for restaurants. By documenting precise measurements and quantities for each dish, restaurants can accurately calculate ingredient costs and portion sizes. This helps in reducing variations in food costs and ensures consistency in quality and portioning.

2. Tracking and Analyzing Sales Data

Tracking and analyzing sales data is essential for effective cost accounting. Restaurants can use point-of-sale (POS) systems to gather detailed information about the sales of each menu item, including the quantity sold, revenue generated, and associated costs. This data allows for accurate cost calculations and helps identify popular and profitable dishes.

3. Regular Inventory Audits

Performing regular inventory audits is crucial to maintain accurate cost accounting records. These audits involve physically counting and verifying the stock of ingredients, beverages, and other supplies. By cross-referencing the physical counts with the recorded inventory, restaurants can identify discrepancies, prevent theft or pilferage, and ensure that cost calculations are based on accurate inventory levels.

By implementing effective cost accounting practices, restaurants can gain better control over their finances, increase profitability, and make informed business decisions. It is essential to regularly review and update cost accounting processes to adapt to changing market conditions and optimize overall performance.