restaurant operating costs percentage

Restaurant operating costs are a crucial aspect of running a successful establishment in the catering industry.Understanding and managing these costs effectively can significantly impact the profitability and overall success of a restaurant.

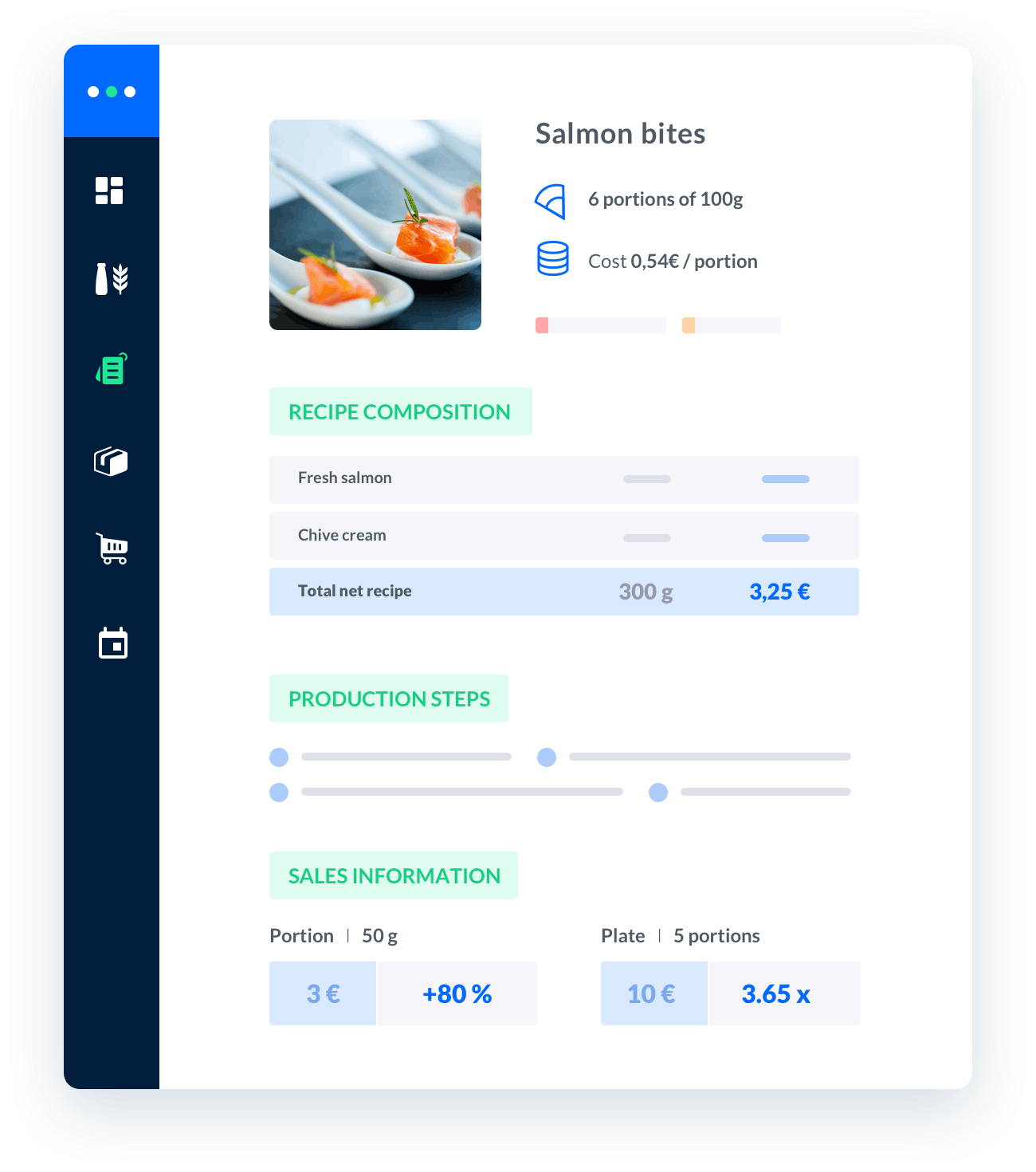

Melba: the food cost app to optimize the profitability of your restaurant

Discover how to optimize the profitability of your restaurant with melba

The ultimate guide to food cost restaurant

Learn more about the food cost basis and how to reduce your food cost percentage

Restaurant operating costs are a crucial aspect of running a successful establishment in the catering industry. Understanding and managing these costs effectively can significantly impact the profitability and overall success of a restaurant. In this comprehensive guide, we will delve into the various components that make up restaurant operating costs and provide valuable insights into the percentage breakdown of these expenses.

What Are Restaurant Operating Costs?

1. Fixed Costs:

Fixed costs are expenses that remain relatively constant regardless of the restaurant's sales volume. These costs are essential for the day-to-day operations and include:

- Rent or mortgage payments

- Property taxes

- Insurance premiums

- Utilities (electricity, water, gas)

- Salaries for non-hourly staff

- Depreciation of assets

2. Variable Costs:

Variable costs fluctuate based on the restaurant's sales volume. As the name suggests, these expenses vary and are directly related to the production or provision of goods and services. Some common variable costs in the catering industry include:

- Cost of ingredients and raw materials

- Hourly wages for staff

- Commissions for sales employees

- Marketing and advertising expenses

- Complimentary items or discounts

Restaurant Operating Costs Percentage Breakdown

It is crucial to understand the percentage breakdown of operating costs to make informed decisions and effectively manage a restaurant's finances. While the exact percentage can vary depending on various factors such as location, size, and concept, a general breakdown is as follows:

1. Cost of Goods Sold (COGS):

Cost of Goods Sold refers to the direct costs associated with producing the food and beverages served in a restaurant. This typically includes the cost of ingredients, raw materials, and any other directly related costs. On average, COGS accounts for around 25-35% of a restaurant's total operating costs.

2. Labor Costs:

Labor costs encompass all expenses related to the workforce in a restaurant, including wages, salaries, benefits, and payroll taxes. This category is usually the largest operating cost for most restaurants, ranging from 25-40% of the total operating costs.

2.1 Front-of-House Labor Costs:

Front-of-House labor costs include the wages and salaries of employees directly involved in customer service, such as servers, hosts, bartenders, and cashiers. Typically, these labor costs account for 5-10% of the total operating costs.

2.2 Back-of-House Labor Costs:

Back-of-House labor costs encompass the wages and salaries of employees involved in food preparation, cooking, dishwashing, and other behind-the-scenes operations. These costs generally range from 10-20% of the total operating costs.

2.3 Management Labor Costs:

Management labor costs include the salaries of restaurant managers, supervisors, and administrative staff. These costs typically account for 5-10% of the total operating costs.

3. Overhead Expenses:

Overhead expenses consist of various indirect costs necessary for the functioning of a restaurant. These costs can include rent, property taxes, utilities, insurance, marketing, and other administrative expenses. On average, overhead expenses make up around 15-30% of a restaurant's total operating costs.

3.1 Rent and Lease Costs:

Rent and lease costs are a significant portion of overhead expenses. These expenses vary depending on the location, size, and demand for the restaurant space. Rent and lease costs generally range from 5-10% of the total operating costs.

3.2 Utilities and Maintenance Costs:

Utilities and maintenance costs include electricity, water, gas, and any expenses associated with the upkeep of the restaurant's facilities and equipment. These costs typically account for 3-6% of the total operating costs.

3.3 Insurance Costs:

Insurance costs cover various types of insurance, including property insurance, liability insurance, workers' compensation insurance, and other necessary coverage. Insurance costs generally range from 2-5% of the total operating costs.

3.4 Marketing and Advertising Costs:

Marketing and advertising costs are essential for promoting the restaurant, attracting customers, and building brand awareness. These costs can vary significantly depending on the marketing strategies employed but typically account for 2-5% of the total operating costs.

4. Miscellaneous Expenses:

Miscellaneous expenses encompass all other operating costs not included in the above categories. These can include bank fees, licenses and permits, professional services, repairs, and maintenance. Miscellaneous expenses typically range from 5-10% of the total operating costs.

Effectively Managing Restaurant Operating Costs

To optimize profitability, it is crucial for restaurant owners and managers to effectively manage operating costs. Here are some tips to help control and reduce expenses:

- Regularly analyze and review expenses to identify areas for cost savings.

- Negotiate favorable terms with suppliers to obtain competitive prices for ingredients and raw materials.

- Implement efficient inventory management systems to minimize waste and control inventory costs.

- Optimize staff scheduling to ensure adequate coverage while minimizing overtime and unnecessary labor costs.

- Invest in energy-efficient equipment and practices to reduce utility costs.

- Monitor and control portion sizes to avoid unnecessary food waste.

- Implement effective marketing strategies that offer a good return on investment.

- Regularly review menu pricing to ensure profitability without sacrificing customer satisfaction.

By implementing these strategies and closely monitoring restaurant operating costs, catering professionals can achieve financial stability and success in a highly competitive industry.