why would labor be treated as a variable cost

When it comes to running a business, there are various costs that need to be considered.One important aspect is understanding the difference between fixed costs and variable costs.

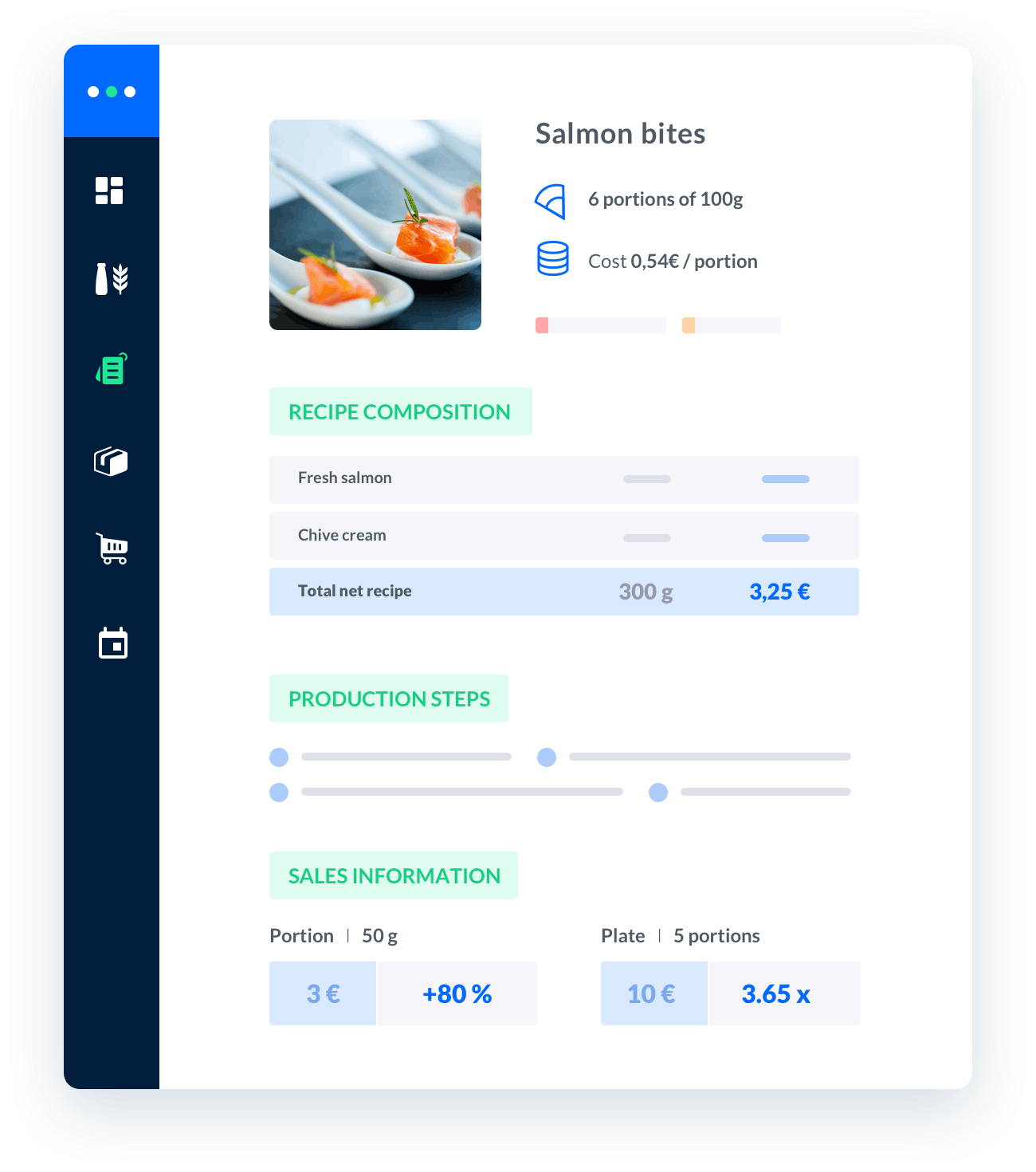

Melba: the food cost app to optimize the profitability of your restaurant

Discover how to optimize the profitability of your restaurant with melba

The ultimate guide to food cost restaurant

Learn more about the food cost basis and how to reduce your food cost percentage

When it comes to running a business, there are various costs that need to be considered. One important aspect is understanding the difference between fixed costs and variable costs. While fixed costs remain constant regardless of the level of production or sales, variable costs fluctuate depending on the volume of production or sales. Labor is often treated as a variable cost due to several reasons, which we will explore in this comprehensive guide.

The Nature of Labor as a Variable Cost

Labour is an essential component of production in many industries, including the catering industry. Here are some reasons why labor is commonly treated as a variable cost:

- Direct Impact on Production Volume: Labor directly affects the volume of production. As the demand for products or services varies, the need for labor also changes. Hiring more or fewer employees allows businesses to adjust their production levels accordingly.

- Hourly Wages and Overtime: Unlike fixed costs, labor costs are often calculated based on hours worked. Employees' wages are typically set on an hourly basis, and any additional hours beyond the regular workweek may incur overtime costs. This flexibility in labor costs aligns with the principles of variable costs.

- Seasonal and Fluctuating Demand: In the catering industry, demand can vary depending on the season, holidays, or special events. Treating labor as a variable cost allows businesses to scale their workforce up or down to meet changing demand patterns.

- Staffing Flexibility: Variable labor costs provide businesses with the flexibility to adjust their workforce based on the current needs. This flexibility allows companies to optimize their labor expenses without compromising the quality of their products or services.

Factors Influencing Labor Costs

Several factors can influence labor costs within the catering industry. It is important to consider these factors when analyzing labor as a variable cost:

1. Skill Level and Experience

The skill level and experience of employees play a significant role in determining labor costs. Skilled and experienced workers may command higher wages due to their expertise, which can impact overall labor expenses. Additionally, more experienced employees may require less training and supervision, indirectly affecting labor costs.

2. Labor Market Conditions

Labor market conditions, such as supply and demand dynamics, can influence labor costs. In regions with a high demand for skilled catering professionals and a limited supply of qualified workers, wages may be higher. Conversely, in areas with a surplus of available labor, wages may be lower.

3. Employee Benefits and Perks

Employee benefits and perks, such as health insurance, retirement plans, and paid time off, also contribute to overall labor costs. These additional expenses should be factored in when considering labor as a variable cost. Offering competitive benefits can attract and retain skilled employees, but it also increases the cost associated with labor.

The Benefits of Treating Labor as a Variable Cost

Adopting labor as a variable cost can bring several advantages to businesses in the catering industry:

1. Cost Control and Efficiency

By treating labor as a variable cost, businesses can exercise greater control over their expenses. During periods of low demand or economic downturns, reducing labor hours or workforce size can help manage costs without compromising productivity. This flexibility allows companies to navigate challenging market conditions more effectively.

2. Scalability and Adaptability

Treating labor as a variable cost enables businesses to scale their workforce up or down as required. During peak seasons or events, additional staff can be hired to meet increased demand. Conversely, during slower periods, businesses can reduce labor costs by adjusting schedules or implementing temporary layoffs. This adaptability helps maintain operational efficiency and profitability.

3. Improved Resource Allocation

Variable labor costs allow businesses to allocate resources more efficiently. By aligning labor with demand, companies can avoid overstaffing or understaffing, optimizing productivity and reducing unnecessary expenses. Proper resource allocation ensures that the right number of employees is available to meet customer needs without incurring excessive costs.

Best Practices in Managing Labor as a Variable Cost

To effectively manage labor costs as a variable cost in the catering industry, businesses can consider the following strategies:

1. Workforce Planning and Scheduling

Thorough workforce planning and scheduling can help optimize labor utilization. Analyzing historical data, seasonal trends, and demand forecasts allows businesses to align staffing levels with anticipated demand. By implementing efficient scheduling practices, such as shift rotations or part-time employment, businesses can better control labor costs.

2. Cross-Training and Skill Development

Encouraging cross-training and skill development among employees can improve labor flexibility. Having a versatile workforce with multiple skill sets allows for smoother adjustments during fluctuations in demand. Cross-trained employees can be deployed across different roles or departments, reducing the need for additional hires and minimizing costs.

3. Performance Monitoring and Incentives

Implementing performance monitoring systems and incentive programs can motivate employees and drive productivity. Rewarding top performers with incentives, such as bonuses or recognition, can foster a culture of excellence and efficiency. By encouraging employees to exceed expectations, businesses can maximize output while keeping labor costs in check.

In conclusion, labor is often treated as a variable cost in the catering industry due to its direct impact on production volume, hourly wages, seasonal demand fluctuations, and staffing flexibility. Understanding the nature of labor as a variable cost allows businesses to effectively manage their expenses, maintain cost control, and optimize resource allocation. By implementing best practices in labor management, businesses can adapt to changing market conditions while ensuring operational efficiency and profitability.